When working with large authorizations and split shipments it is very important to consider how this is handled.

If the proper work-flow is not used you may end up reserving more funds than the customer have available leading to transactions getting rejected.

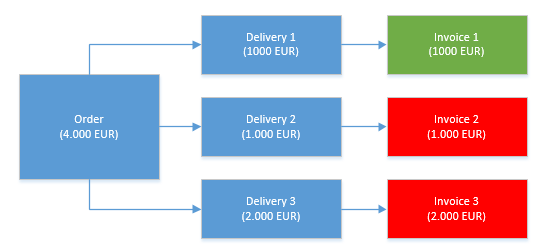

Scenario:

1.A order is created for 4000 EUR with an authorization on 4000 EUR

2.This order is copied into multiple delivers during a short period of time

3.Each delivery is after having been created copied into an invoice document

4.The invoice document is settled using iPayment as you want to pull the money for the partial shipment when the delivery is made

The issue arrives as iPayment will use the initial authorization on the order to settle the first invoice (can only be used once).

This will mark the authorization as settled even if you only settle a small amount of the initial authorization.

Example:

Sales order is 4000 EUR

Invoice is 1000 EUR

iPayment will settle the first invoice using the 4000EUR authorization (but will off cause only draw 1000 EUR).

The next time you create a delivery and invoice you settle an additional 1000 EUR. This will create a new settlement without a reference to the 4000EUR authorization as this has already been used to settle the first invoice.

At some point in the future you create the last delivery for the remaining amount (2000 EUR) and invoice this.

Flow:

The issue that might be is that the customer’s account does not have the funds needed to complete invoice 2 and 3 as the 4000EUR is still reserved by the original authorization (normally 7-10 days) despite that is has already been settled.

Technically a authorization cannot be re-used when it has been settled and even after doing the settlement some of the funds will still be held until the funding for the settlement completes.

Example from CyberSource

"After the $25 settlement is processed against the original $100 authorization hold, the remaining funds ($75) are still being held on the customer's card. Depending on the card type and payment processor in use, CyberSource or your processor may initiate a partial authorization reversal request against the $75 remainder of the funding hold once the $25 settlement request has been received and processed by the payment processor. If the customer's issuing bank approves of the partial authorization reversal, the remaining funding hold will be returned back to the card before the $25 settlement funds completely; else,

the remaining funds being held will be returned to the customer's card once the funding for the $25 settlement completes."[Link]

Due to the above we do not recommend authorizing large amounts at the Sales Order level if you are going to use split shipments as you may then start getting your transactions rejected when processing the invoice.

Please see the child chapter to identify the alternative work-flow suitable for your business.

Gateway specific functionality

Trust Payments (Secure Trading) have some very specific functionality to handle the above scenario. However this comes with certain limitations.

•Only certain acquiring banks support split shipments

•Only VISA/Master Card can be used

With the above limitations in mind we have decided to not implement gateway specific logic as the main merchant bank (Trust Payments (Secure Trading) Financial Services) does not support this and it would be limited to specific card types.

Other gateways (Authorize.NET/CyberSource etc.) does not have any specific logic for handling split shipments and instead recommend creating a suitable work-flow [Link].